19+ Cash out refi rates

You can get up to 80 percent of your homes current value in a cash-out refinance. Reviewed by Greg McBride CFA On Thursday September 01 2022 the national average 30-year fixed refinance APR is 5940.

1

Cash Out Mortgage Refinancing LTV Calculator Enter Your Current Home Value Mortgage Information Current Seattle Mortgage Refinance Rates A Homeowners Guide to.

. But remember rates for cash-out refinances tend to be 0125 to 025 higher than rates rate-and-term no-cash-out refinances Lender. This is another big factor. 30-year fixed at 3 3053 APR 20-year fixed at 2875 2953 APR 15-year fixed at 25 2506 APR Is now a good time for a cash-out refinance.

You typically receive the cash shortly after. A mortgage balance of 150000. The higher your LTV the higher the riskiness of your loan.

Get cash back at closing from the. This time last week the 30-year fixed APR was. Getting a cash-out refinance loan in 2021 wouldve allowed you to lower your rate and take out cash in the process.

Your current mortgage loan appraised value of the home your loan-to-value ratio For example if your current mortgage balance is 150000 and your home is worth 300000 then your loan. Seems a bit high IMO but I have never gone through this process before. The average APR on a 15-year fixed-rate mortgage rose 14 basis points to 5102 and the average APR for a 5-year adjustable-rate mortgage ARM fell 7 basis points to 5227.

Your loan type also has an effect on your cash-out closing costs. 8668003221 Mon-Fri 8 am. Cash-Out Refi Speeds April 19 2022 Mortgage rates have risen nearly 200bp from the final quarter of 2021 squelching the most recent refinancing wave and leaving the.

The average 15-year fixed refinance APR is. Current Cash Out Refi Rates 2022 Table of Contents. ET Schedule an appointment Todays low refinance rates View current refinance rates for fixed-rate and adjustable-rate.

A cash-out refi that uses your homes equity can be a way to fund an education without taking out multiple student loans. Cash out refi rates Conventional Cash - out Refinance Loan 1. Todays Cash-Out Refinance Rates Products Rate APR.

The golden years The Society of. Check out our special offer. Take advantage of smart financial advice about mortgage rates from bankrate.

If youre refinancing to lower your interest rate you typically. Current rates are as low as. You will be able to take out 50000 as cash.

With adjustable-rate mortgages discount points adjust interest rates by 0375 though the discount only applies during the introductory period. Low out-of-pocket cost refinance options are available to qualifying borrowers. Refinance up to 80 of the value of your home.

80 of 250000 200000. Cash Out Refi Jumbo Rates 2022. Can someone recommend a good lender for an Indiana property or tell me if 35 on a 20 year cash-out refi is good.

Does not apply to taxes insurance or pre-paid interest. The lender you choose can make a huge. Cash Out Mortgage Refinancing LTV Calculator Enter Your Current Home Value Mortgage Information Current.

But keep in mind youll need to have sufficient equity. As with a conventional cash-out refi everything depends upon the equity you have built up in your property. Todays Mortgage Refinance Rates The average APR for a 30-year fixed refinance loan increased to 597 from 589 yesterday.

Most programs dont allow borrowers to take more than 80 of their homes value in a cash out. 200000 150000 your mortgage balance 50000. Discount points can also be negative.

ET Sat 8 am. For a cash-out refinancing on a conventional loan theres typically a 3 fee cap subject to the ability to payqualified mortgage. The greater the equity the more likely you are to qualify for refinancing and the more.

How much money can you get in a cash-out refinance. Cash-out refinancing programs also have an advantage over home equity lines of credit in that they typically come with fixed rates as opposed to the variable interest rates.

Why Exponential Growth Is So Scary For The Covid 19 Coronavirus

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

How To Choose 529 Plans For Your Child S Education Moneygeek Com

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

3

1

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

The Aaron Duez Team Home Facebook

19 Massive Millennial Spending Statistics Spendmenot

The Perfect Financial Advisor White Coat Investor

Why Exponential Growth Is So Scary For The Covid 19 Coronavirus

Bonita Springs Estero July 2022 I Mattbrownrealestate Inaples Fl

19 Uber Revenue Statistics Every Traveler Should Know In 2021

Check Into Cash Near You 1225 Locations Reviews September 2022 Compacom Compare Companies Online

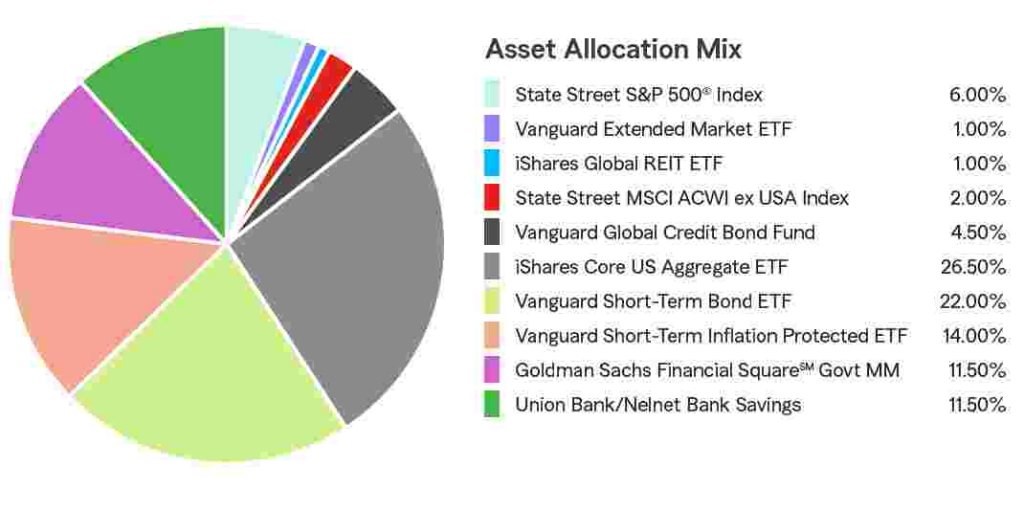

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

Credit Score Meme

Benefits Of Having A Good Credit Score